Switzerland’s Creative Industries: Facts and Figures

6% of all employees in Switzerland work in the creative industries, the majority of them in very small businesses. Overall growth is expected to continue, despite the decline in turnover of large market segments such as the music and publishing industries. A summary of the key data.

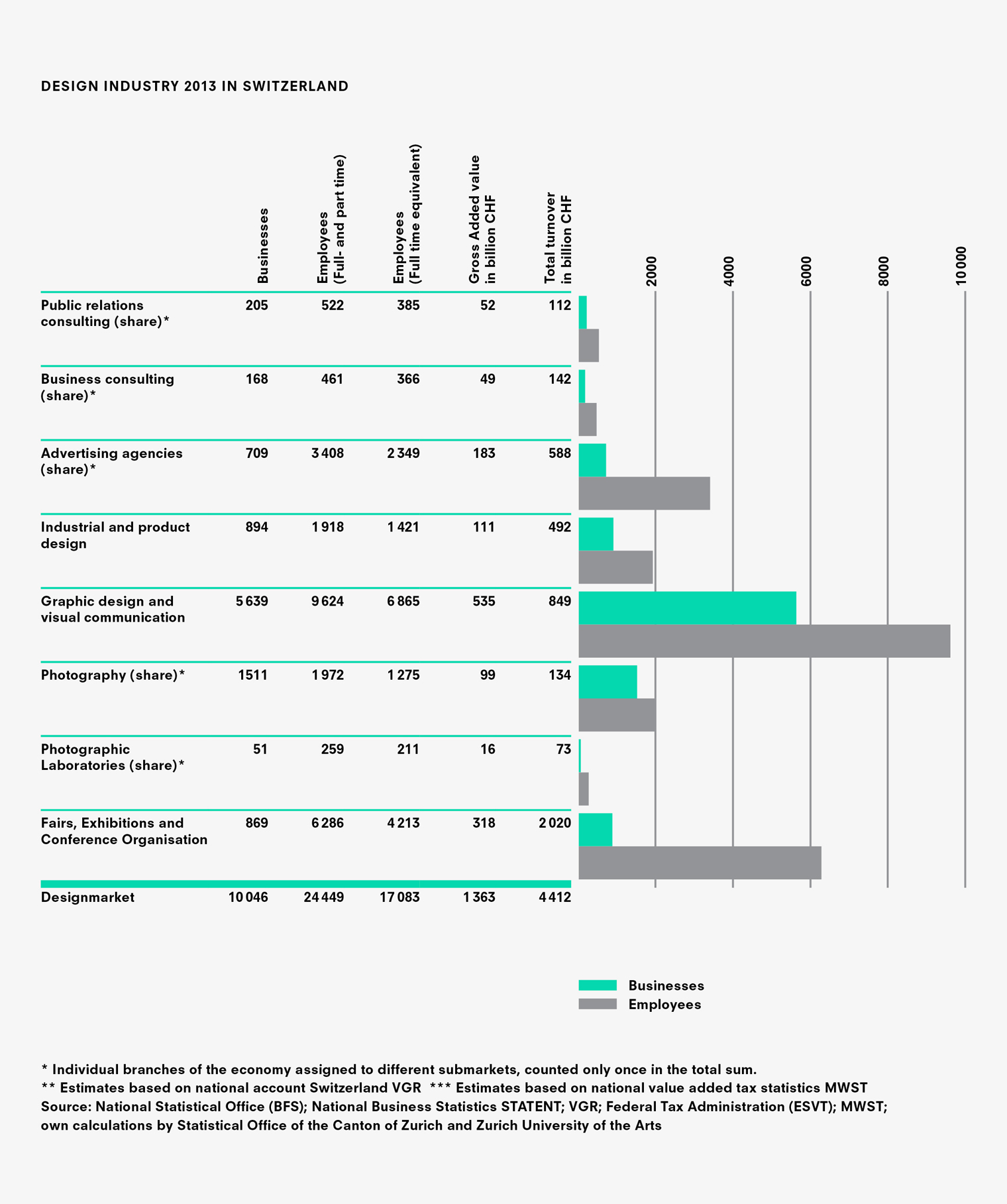

Table Creative Industries Switzerland 2013 (Creative Economy Report 2016, p. 9)

A significant contribution to the Swiss economy

In 2013, the creative industries in Switzerland employed roughly 275’000 people in around 71’000 businesses. This represents 11% of Swiss businesses and 6% of all employees. Employment is highest in architecture, the software and games industry, music and the press market. These four submarkets account for roughly half of all cultural and creative industry professionals.

The Swiss cultural and creative industries generated an estimated Gross Added Value (GAV) of 22.3 billion Swiss Francs and an estimated turnover of 68.6 billion. This amounted to almost 4% of Switzerland’s total GAV.

Dynamic growth

The number of businesses and employees in the cultural and creative industries is growing faster than in the overall economy. This dynamic development is expected to continue.

Between 2012 and 2013, the average number of employees in all submarkets increased by 1.7%, the number of businesses by over 4.6%. Thus, the cultural and creative industries grew faster than the overall economy, where the number of businesses increased three times less (+1.6%) and the number of employees roughly a third less (+1.2%).

The impact of decline in the large submarkets

Compared to the number of employees and businesses, which significantly exceeded corresponding figures for the overall economy, GAV and turnover showed a different picture. Whereas between 2012 and 2013 creative industry GAV grew almost parallel to the overall Swiss economy (+1.6% compared to +1.8%), creative industry turnover lagged somewhat behind (+0.4% compared to +1.2%).

The lower turnover compared to the economy at large can be attributed to the decline in some of the large submarkets, particularly the music and the press industries. Two of the three highest turnover submarkets stagnated (software and games industry –0.3%; architecture +0.7%). The press market, however, declined by 3%. Conversely, the art market increased by almost 16%, and film (+9,1%) and design (+6.3%) also displayed impressive dynamics. According to national VAT statistics, the music business suffered the greatest slump. Total turnover amounted to CHF 1.8 billion or a decrease of almost 6%.

For a more detailed analysis of the relative sizes and developments of the 13 submarkets, see this summary.

The importance of micro-businesses

Figures for 2013 confirm that Swiss creative industries are dominated by small businesses. 96% are so-called micro-businesses employing up to 10 people (full time equivalents). Three quarters consist of merely one or two persons, sometimes described as “nano-businesses”.

More than half of all Swiss cultural and creative industry professionals work in micro-businesses. Some businesses diverge from this overall picture due to their production conditions. Thus, the high share of large businesses (250+ employees) in broadcasting can be explained by the few businesses active on the small Swiss market and by resource-intensive production.

This segmentation has its challenges as well as advantages. Small means flexible, and being able to merge into network-like structures to create new, innovative production and utilisation contexts. Small also means dispersal, barely possessing any flagship enterprises able to shape public perception or conduct professional lobbying.

Switzerland in an international comparison

Within a global context, a recent study shows that the creative industries generate revenue of 2250 Billion dollars annually and account for 29.5 million jobs, or 1% of the actively employed population. Small-scale structures predominate. Analysis suggests that these favour innovative business models and include a high percentage of self-employed workers - in the USA, three times more than for the overall economy. The percentage of women employees is also significantly higher than in traditional industries.

From a European perspective, creative industries are an established and strategically important economic factor, as evidenced in the strategy paper Europe 2020. The creative industries are projected to contribute 3% of Europe’s GDP and are linked to developing sustainable outcomes in employment, innovation, education, poverty reduction, and climate/energy goals.

Within Switzerland, the field is also dynamic and changing alongside these European and global developments. The terminology has changed since the first report in 2003 from cultural industries to creative industries, reflecting the gradual shift away from thinking in terms of traditional cultural activities. This report continues this trend by introducing the creative economies model, which expands the focus beyond the traditional creative business sectors to focus on actors that operate in various creative roles, translating between different sectors in the economy as a whole.

References

CISAC (2015): Cultural times, the first global map of cultural and creative industries

European Commission http://ec.europa.eu/ europe2020/index_de.htm (accessed 12.4.2016)